Unveiling the intricacies of New York State’s Tax Map: A Comprehensive Guide

Related Articles: Unveiling the intricacies of New York State’s Tax Map: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling the intricacies of New York State’s Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the intricacies of New York State’s Tax Map: A Comprehensive Guide

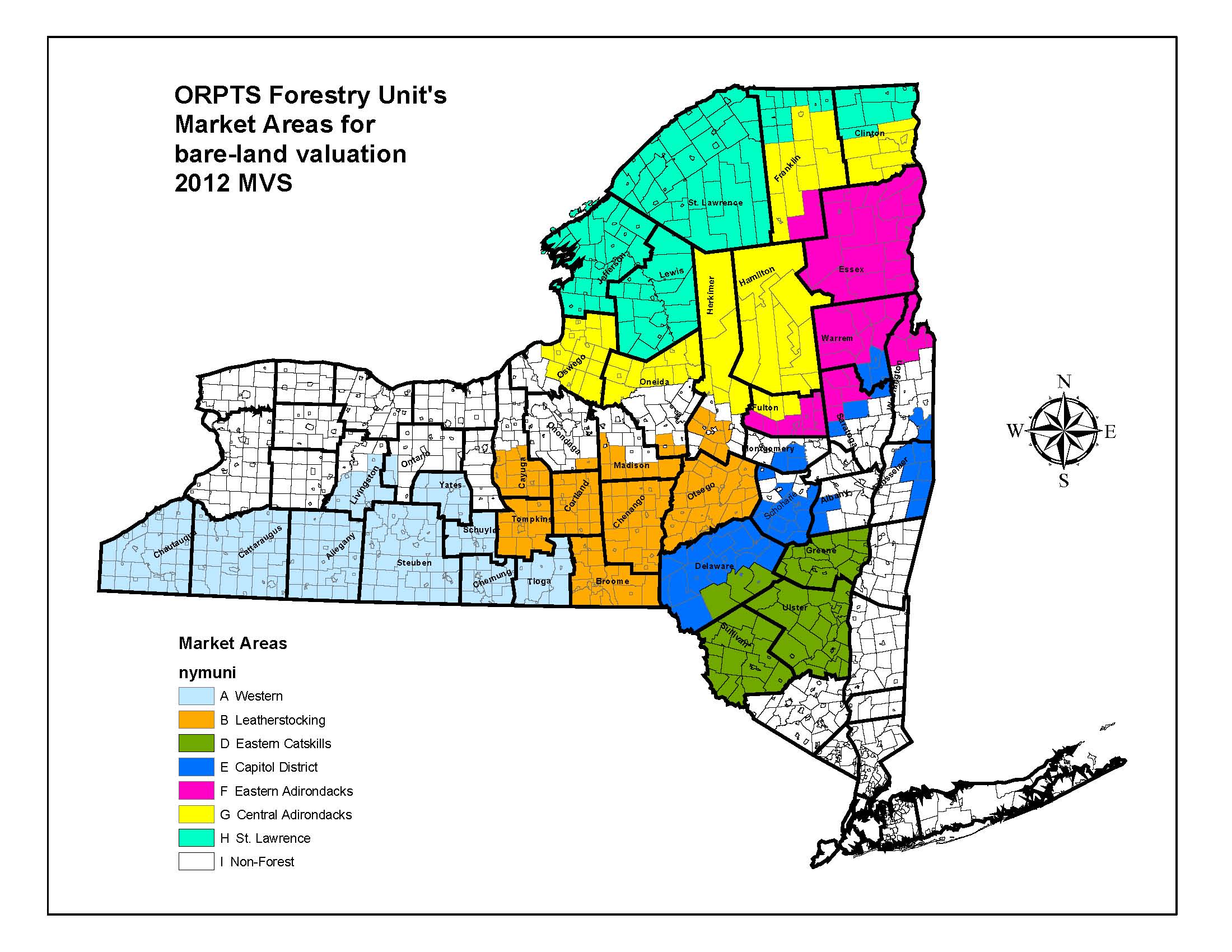

The New York State Tax Map, a vital tool for property owners, municipalities, and government agencies alike, serves as a comprehensive and detailed representation of real property throughout the state. This intricate system, meticulously maintained and updated, offers a wealth of information crucial for various aspects of property management, assessment, and taxation.

Understanding the Core of the New York State Tax Map

The New York State Tax Map is a standardized system that visually depicts the boundaries of all real property within a municipality, encompassing both land and improvements. Each parcel of land is assigned a unique identification number, known as the "tax map parcel number," which acts as a unique identifier for that specific property. This numbering system facilitates efficient tracking and management of real estate data.

Key Components of the Tax Map

The New York State Tax Map consists of several key components, each serving a distinct purpose:

- Base Map: This forms the foundation of the tax map, depicting the geographical features of the municipality, including roads, rivers, and other natural landmarks. It provides a visual context for the property boundaries.

- Parcel Boundaries: These lines define the limits of each individual property, clearly delineating ownership and separating adjacent parcels.

- Tax Map Parcel Number: As previously mentioned, each parcel is assigned a unique identification number, enabling efficient record-keeping and property identification.

- Property Information: The tax map incorporates essential details about each property, including its size, zoning classification, and ownership details.

- Assessment Information: The tax map includes the assessed value of each property, which is used to calculate property taxes.

Benefits of the New York State Tax Map

The New York State Tax Map offers numerous benefits for various stakeholders:

- Property Owners: The tax map provides clear documentation of their property boundaries, aiding in property management, boundary disputes, and potential property sales.

- Municipalities: The tax map serves as a vital tool for property assessment, tax collection, and planning purposes. It helps municipalities maintain accurate property records and ensure fair taxation.

- Government Agencies: The tax map assists government agencies in various functions, including land use planning, environmental regulations, and emergency response.

- Real Estate Professionals: Real estate agents, appraisers, and other professionals rely on the tax map for property research, market analysis, and transaction support.

Navigating the New York State Tax Map

The New York State Tax Map is accessible through various means, offering flexibility to users:

- Online Access: Many municipalities provide online access to their tax maps, allowing users to view and search for property information conveniently.

- Physical Copies: Printed copies of tax maps are often available at municipal offices, offering a tangible reference for property information.

- GIS Systems: Geographic Information Systems (GIS) are increasingly used to manage and visualize tax map data, offering advanced capabilities for analysis and spatial data management.

Importance of Accuracy and Maintenance

The accuracy and up-to-date nature of the New York State Tax Map are crucial for its effectiveness. Regular updates and maintenance are essential to reflect changes in property boundaries, ownership, and other relevant information. This ensures the map remains a reliable source of information for all stakeholders.

Frequently Asked Questions (FAQs) about the New York State Tax Map

1. How can I access the tax map for my municipality?

- The best way to access the tax map for your municipality is to contact your local assessor’s office or visit their website. Many municipalities provide online access to their tax maps.

2. What information can I find on the tax map?

- The tax map provides information about property boundaries, ownership, assessed value, zoning classification, and other relevant details.

3. How are tax map parcel numbers assigned?

- Tax map parcel numbers are assigned based on the location of the property within the municipality. The numbering system typically follows a grid pattern, with numbers increasing sequentially as you move across the map.

4. Can I use the tax map to determine property value?

- The tax map provides the assessed value of the property, which is not necessarily the same as its market value. To determine the market value of a property, you should consult with a real estate appraiser.

5. How often is the tax map updated?

- The frequency of updates to the tax map varies depending on the municipality. However, most municipalities update their tax maps annually to reflect changes in property boundaries, ownership, and other relevant information.

Tips for Utilizing the New York State Tax Map

- Familiarize yourself with the layout and symbols: Understanding the map’s organization and symbols will help you navigate it effectively.

- Use the search function: Online tax maps often have search functions that allow you to quickly find specific properties by address or parcel number.

- Contact the assessor’s office for assistance: If you have any questions or need help interpreting the tax map, contact your local assessor’s office.

- Verify information: Always double-check the information on the tax map with other sources, such as property deeds or tax records.

- Stay informed about updates: Check for updates to the tax map regularly to ensure you have the most current information.

Conclusion

The New York State Tax Map stands as a critical resource for property owners, municipalities, and government agencies, facilitating efficient property management, assessment, and taxation. Its comprehensive nature, coupled with readily available access, empowers stakeholders with accurate information and valuable insights. Understanding the intricacies of the tax map and its applications can prove invaluable in navigating the complexities of real estate in New York State.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the intricacies of New York State’s Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!