Navigating the Landscape: A Comprehensive Guide to Otsego County, New York’s Tax Map

Related Articles: Navigating the Landscape: A Comprehensive Guide to Otsego County, New York’s Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape: A Comprehensive Guide to Otsego County, New York’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: A Comprehensive Guide to Otsego County, New York’s Tax Map

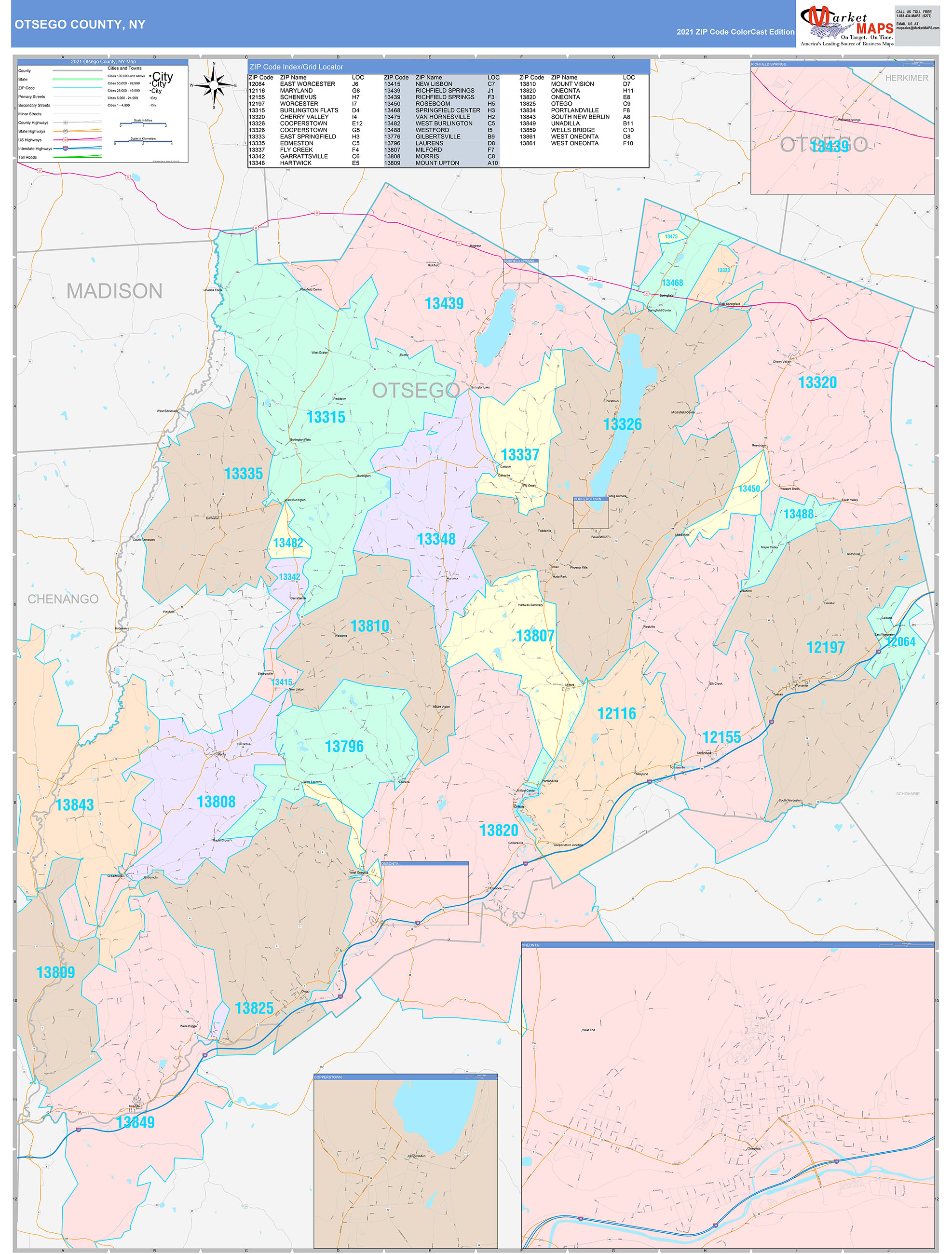

Otsego County, New York, a picturesque region renowned for its rolling hills, sparkling lakes, and rich history, is also home to a robust and well-structured tax system. At the heart of this system lies the Otsego County Tax Map, a vital tool for understanding property ownership, assessing property values, and ensuring fair taxation.

Understanding the Otsego County Tax Map

The Otsego County Tax Map is a detailed, geographically organized representation of all properties within the county. It serves as a visual and informational guide, providing essential details about each parcel of land, including:

- Property Address: The official street address of the property.

- Parcel Number: A unique identifier assigned to each individual property.

- Property Owner: The name and contact information of the current property owner.

- Property Size: The total acreage or square footage of the property.

- Land Use: The designated purpose of the property, such as residential, commercial, or agricultural.

- Tax Assessment: The estimated market value of the property, used to calculate property taxes.

Accessing the Otsego County Tax Map

The Otsego County Tax Map is readily accessible to the public through various channels:

- Otsego County Real Property Services: The county’s Real Property Services department maintains and updates the tax map. It can be accessed online through the county’s official website.

- Town and Village Offices: Each town and village within Otsego County has access to the tax map for properties within their jurisdiction.

- Private Mapping Services: Several private mapping services, such as Google Maps and MapQuest, may offer limited access to the tax map data.

The Importance of the Otsego County Tax Map

The Otsego County Tax Map plays a crucial role in ensuring a transparent and equitable tax system. Its significance extends to various aspects of property management and community development:

- Property Assessment: The tax map provides accurate information about property boundaries, size, and land use, facilitating fair and accurate assessments.

- Tax Collection: The map allows tax authorities to identify property owners and ensure timely and efficient tax collection.

- Property Transactions: The map serves as a valuable resource for real estate professionals and individuals involved in property sales, ensuring accurate property identification and details.

- Land Planning and Development: The tax map provides insights into land ownership, zoning regulations, and existing infrastructure, aiding in land planning and development decisions.

- Public Access and Transparency: The availability of the tax map promotes transparency and accountability in the county’s tax system, allowing residents to access information about property ownership and assessments.

Benefits of Using the Otsego County Tax Map

Utilizing the Otsego County Tax Map offers numerous benefits for individuals, businesses, and the community as a whole:

- Clear Property Identification: The map provides a definitive visual representation of property boundaries, ensuring accurate identification and preventing disputes.

- Informed Decision-Making: Access to detailed property information empowers individuals and businesses to make informed decisions regarding property purchases, development, or investments.

- Transparency and Accountability: The public availability of the tax map fosters transparency and accountability in the county’s tax system, promoting trust and confidence.

- Efficient Property Management: The map simplifies property management by providing readily accessible information about ownership, assessments, and land use.

- Community Planning and Development: The map serves as a valuable tool for community planning and development, facilitating informed decisions about land use, infrastructure, and services.

FAQs about the Otsego County Tax Map

1. How do I find the parcel number for my property?

You can find your property’s parcel number by searching the Otsego County Tax Map online or by contacting the county’s Real Property Services department.

2. Can I access the tax map for a specific town or village?

Yes, the tax map is available for each town and village within Otsego County. You can access it through the respective town or village office or online through the county’s website.

3. What information is included in the tax map?

The tax map provides detailed information about each property, including its address, parcel number, owner, size, land use, and tax assessment.

4. How often is the tax map updated?

The tax map is updated regularly to reflect changes in property ownership, assessments, and land use. The frequency of updates varies depending on the nature of the changes.

5. What are the legal implications of the tax map?

The tax map serves as a legal document, providing official information about property ownership and boundaries. It is used in court proceedings and other legal matters involving property rights.

Tips for Using the Otsego County Tax Map

- Familiarize yourself with the map’s layout: Understand the different sections and symbols used to represent property information.

- Use the search function: Utilize the search function to quickly find specific properties based on address, parcel number, or owner name.

- Verify property information: Always cross-check information from the tax map with other sources, such as property deeds or public records.

- Contact the Real Property Services department for assistance: If you have any questions or need help interpreting the tax map, contact the county’s Real Property Services department.

Conclusion

The Otsego County Tax Map is an invaluable resource for understanding property ownership, assessments, and the county’s tax system. Its accessibility and comprehensive nature promote transparency, efficiency, and informed decision-making for individuals, businesses, and the community as a whole. By leveraging the information provided by the tax map, residents and stakeholders can effectively manage property, navigate transactions, and contribute to the continued development of Otsego County.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Comprehensive Guide to Otsego County, New York’s Tax Map. We thank you for taking the time to read this article. See you in our next article!