Navigating the Houston Flood Insurance Rate Map: A Guide to Understanding Your Risk

Related Articles: Navigating the Houston Flood Insurance Rate Map: A Guide to Understanding Your Risk

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Houston Flood Insurance Rate Map: A Guide to Understanding Your Risk. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Houston Flood Insurance Rate Map: A Guide to Understanding Your Risk

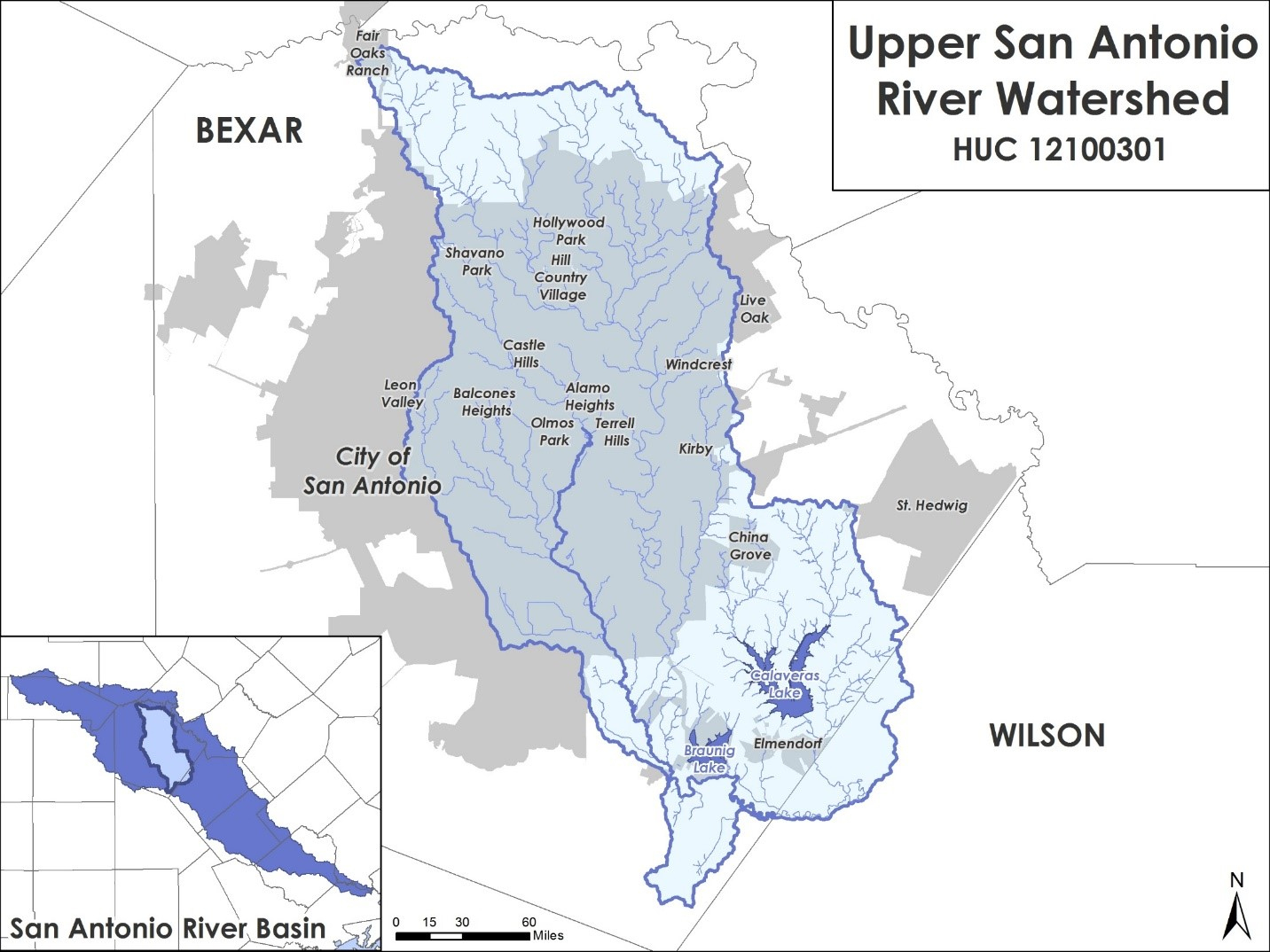

The Houston Flood Insurance Rate Map (FIRM) is a vital tool for understanding flood risk and ensuring adequate protection for homes and businesses in the Houston metropolitan area. This map, developed and maintained by the Federal Emergency Management Agency (FEMA), provides a comprehensive overview of flood zones, risk levels, and insurance requirements within the city.

Understanding the Houston Flood Insurance Rate Map

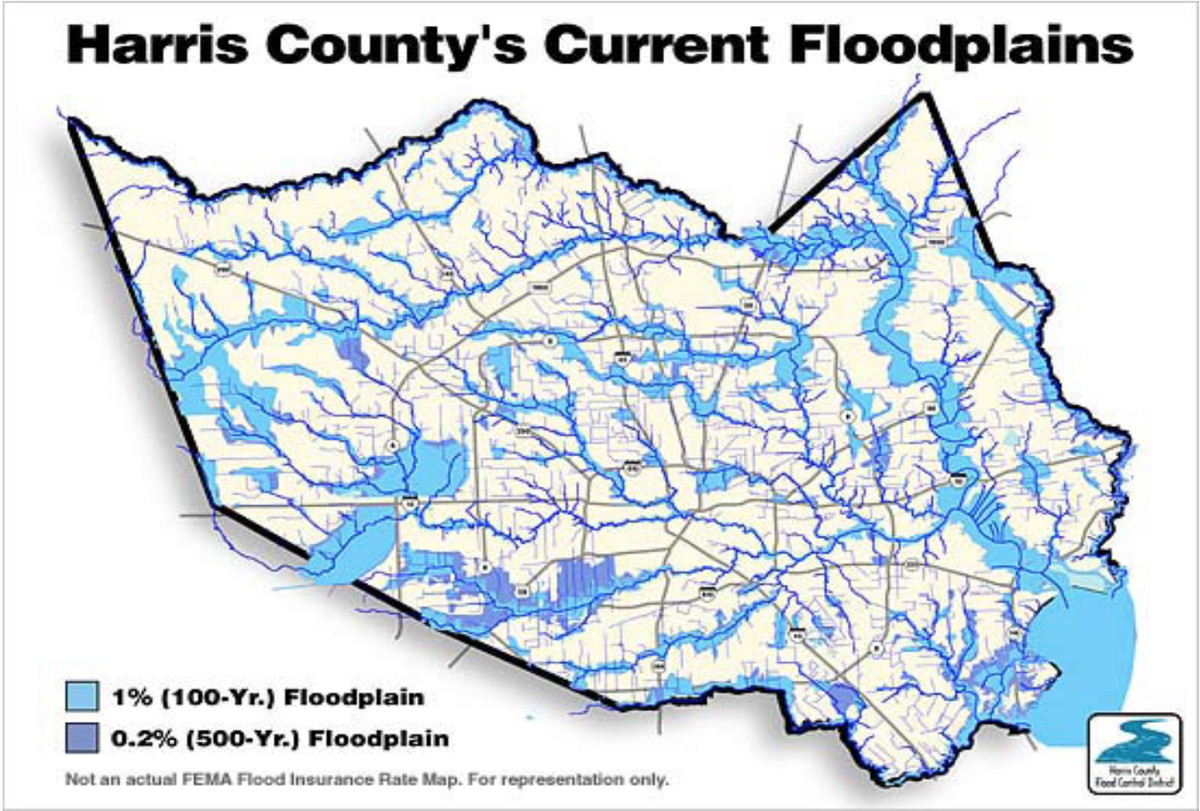

The Houston FIRM is a complex document that visually represents flood zones across the city. It utilizes a color-coding system to identify areas with varying degrees of flood risk, ranging from low to high. These zones are categorized into three primary groups:

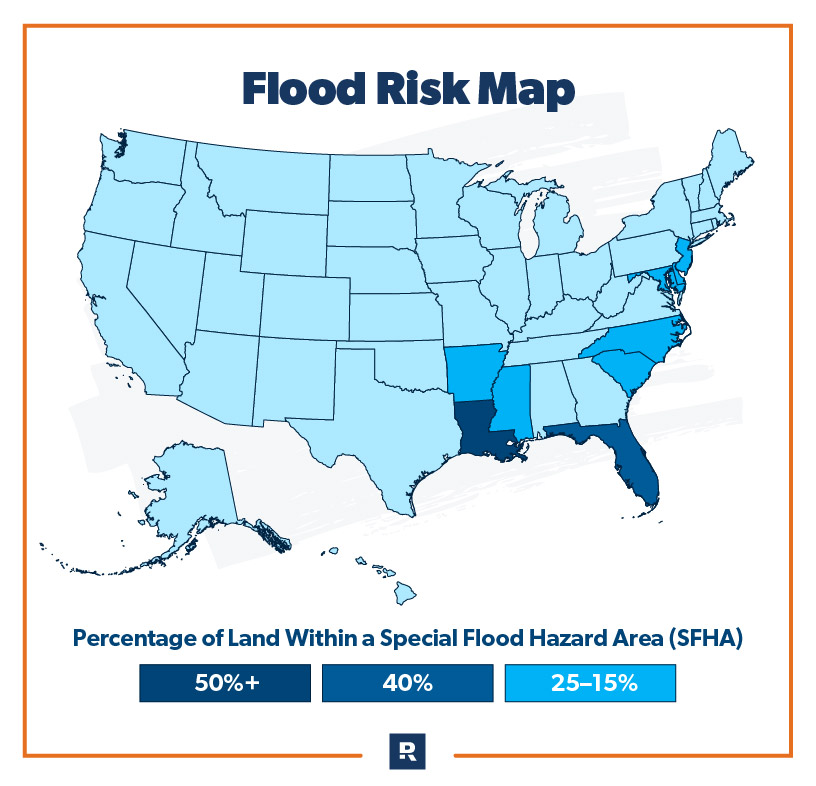

- Special Flood Hazard Areas (SFHAs): These zones have a 1% or greater chance of flooding during any given year. They are further subdivided into zones A, AE, A99, and AO, each indicating specific flood characteristics.

- Areas of Minimal Flood Hazard (AML): These zones have a less than 1% chance of flooding annually. However, they are still subject to flood risk and may be required to purchase flood insurance depending on their location and specific characteristics.

- Areas of Undetermined Flood Hazard (UD): These areas have not been adequately studied for flood risk and are subject to potential designation as SFHAs.

Navigating the Map: A Closer Look

The Houston FIRM is available online and can be accessed through FEMA’s website. The map provides detailed information about each flood zone, including:

- Flood Zone Designation: The specific zone designation (e.g., A, AE, AO) helps understand the type of flood hazard and the corresponding insurance requirements.

- Base Flood Elevation (BFE): This elevation indicates the height to which floodwaters are expected to rise during a 100-year flood event.

- Flood Insurance Rate (FIR): This rate determines the cost of flood insurance based on the flood zone and the property’s characteristics.

The Significance of the Houston Flood Insurance Rate Map

The Houston FIRM plays a crucial role in flood risk management and insurance planning. It serves as a foundation for:

- Determining Flood Insurance Requirements: For properties located within SFHAs, flood insurance is typically mandatory if a mortgage is involved. The FIRM helps determine the specific insurance requirements based on the flood zone designation.

- Estimating Flood Risk: The map provides a visual representation of flood zones, allowing homeowners and businesses to understand their potential exposure to flood hazards.

- Informing Development Decisions: The FIRM serves as a guide for developers and planners, helping them make informed decisions about land use and development in flood-prone areas.

- Supporting Flood Mitigation Efforts: By identifying areas with high flood risk, the FIRM helps prioritize flood mitigation measures and infrastructure improvements.

FAQs about the Houston Flood Insurance Rate Map

1. What is the difference between a Zone A and a Zone AE?

Zone A represents areas with a 1% or greater chance of flooding, but the precise flood depth and velocity are unknown. Zone AE, on the other hand, has a defined Base Flood Elevation (BFE), indicating the height to which floodwaters are expected to rise during a 100-year flood event.

2. What does it mean if my property is in an Area of Minimal Flood Hazard (AML)?

While AML areas have a less than 1% chance of flooding annually, they are not entirely immune to flood risk. Depending on their location and specific characteristics, these properties may still be required to purchase flood insurance.

3. How do I find out if my property is located in a flood zone?

The Houston FIRM is available online through FEMA’s website. You can search for your property address to determine its flood zone designation and associated information.

4. What happens if my property is in an Area of Undetermined Flood Hazard (UD)?

UD areas have not been adequately studied for flood risk and are subject to potential designation as SFHAs. If your property falls within a UD area, it is advisable to contact FEMA or a qualified insurance agent for guidance.

5. How does the Houston FIRM affect my flood insurance premiums?

The FIR is directly influenced by the flood zone designation. Properties located in higher-risk zones, such as SFHAs, typically have higher insurance premiums compared to those in AML areas.

6. What are the benefits of purchasing flood insurance?

Flood insurance provides financial protection against flood damage to your property. It can cover losses such as structural damage, personal belongings, and living expenses during the recovery period.

7. What are the consequences of not having flood insurance?

Without flood insurance, you are personally responsible for covering the costs of flood damage. This can lead to significant financial hardship, especially if the damage is extensive.

Tips for Navigating the Houston Flood Insurance Rate Map

- Consult a Qualified Insurance Agent: An experienced agent can help you understand your flood risk, explain your insurance options, and navigate the complexities of the FIRM.

- Review Your Flood Insurance Policy: Ensure your policy provides adequate coverage for your property and its contents. Consider increasing your coverage limits if necessary.

- Implement Flood Mitigation Measures: Implementing flood mitigation measures, such as elevating your home or installing flood barriers, can reduce your flood risk and potentially lower your insurance premiums.

- Stay Informed about Flood Hazards: Be aware of flood risks in your area and stay informed about weather forecasts and potential flooding events.

- Consider Participating in Flood Mitigation Programs: FEMA and other organizations offer flood mitigation programs that can provide financial assistance for implementing flood-resistant improvements.

Conclusion

The Houston Flood Insurance Rate Map is an indispensable resource for understanding flood risk and making informed decisions about flood insurance. By understanding the map’s intricacies and utilizing the available resources, homeowners and businesses can better prepare for potential flooding events and protect their assets. While flood insurance may seem like an added expense, it provides crucial financial protection against the devastating consequences of flood damage.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Houston Flood Insurance Rate Map: A Guide to Understanding Your Risk. We hope you find this article informative and beneficial. See you in our next article!