Navigating the City: A Comprehensive Guide to the NYC GIS Tax Map

Related Articles: Navigating the City: A Comprehensive Guide to the NYC GIS Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the City: A Comprehensive Guide to the NYC GIS Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the City: A Comprehensive Guide to the NYC GIS Tax Map

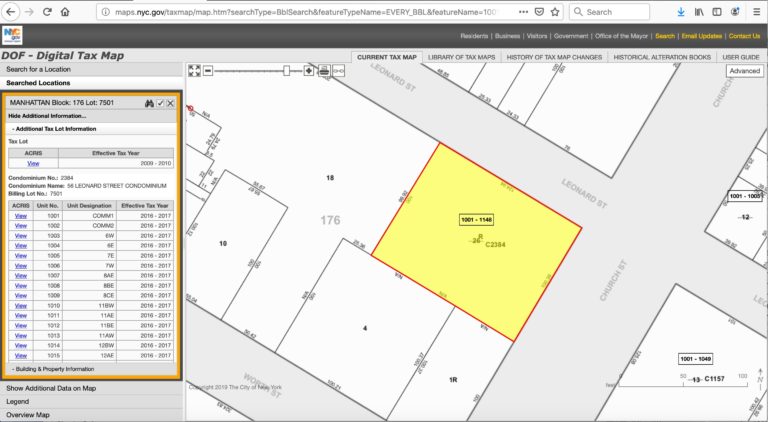

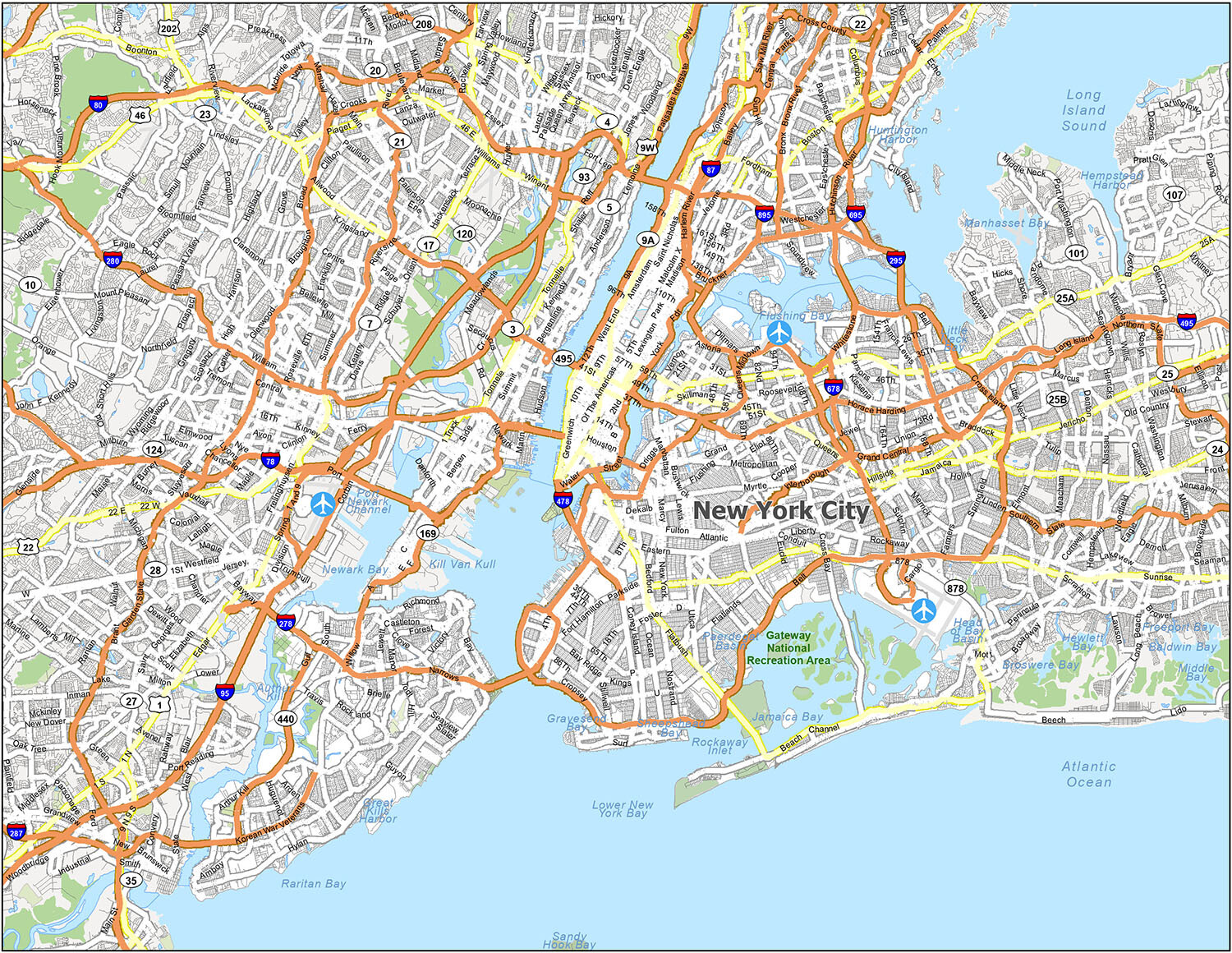

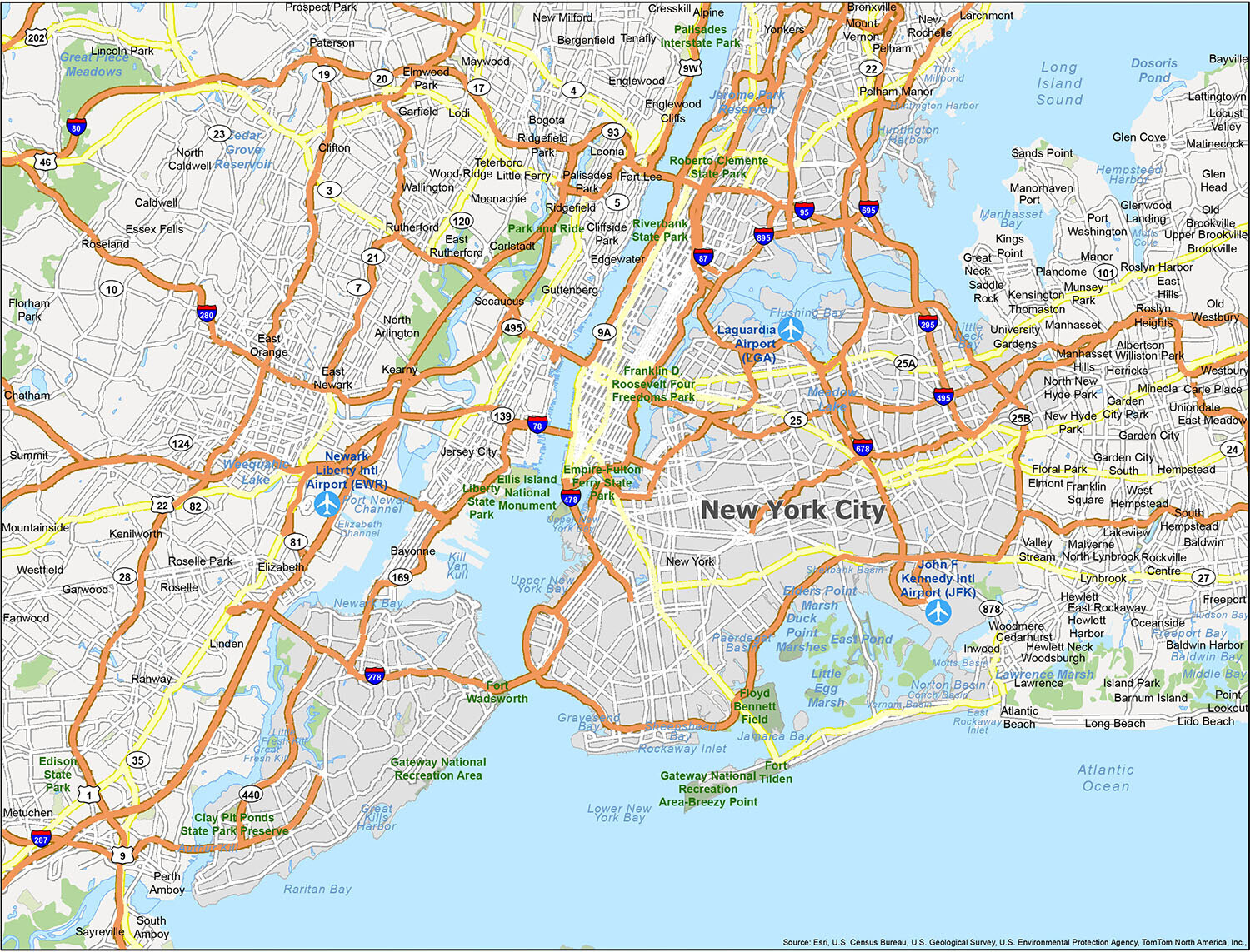

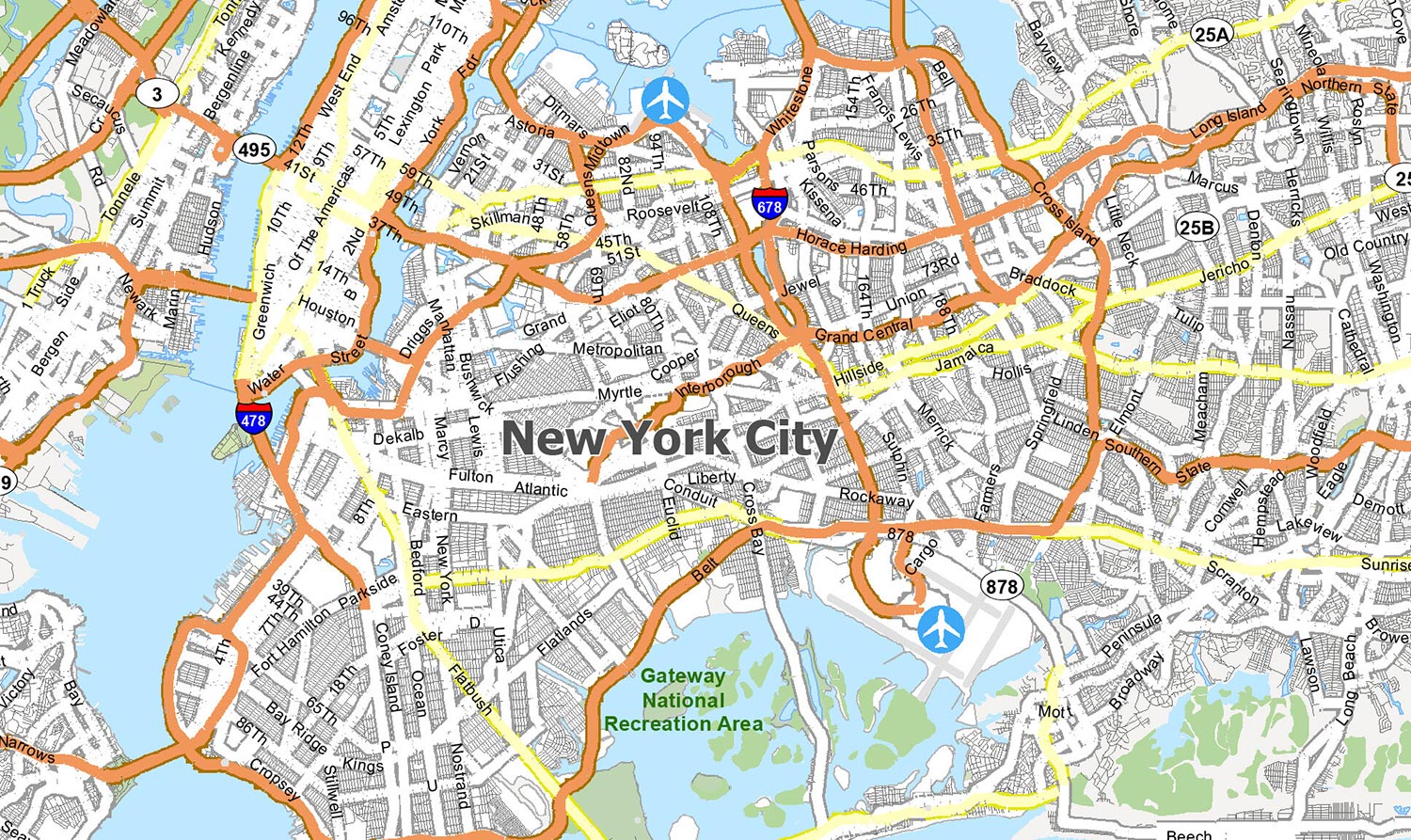

The New York City Geographic Information System (GIS) Tax Map, a powerful online tool, serves as a comprehensive database and visual representation of the city’s real estate landscape. It provides detailed information on properties, including their boundaries, ownership, and tax assessments, making it an indispensable resource for various stakeholders, from real estate professionals and developers to individual homeowners and curious citizens.

Understanding the NYC GIS Tax Map: A Visual and Data-Rich Resource

The NYC GIS Tax Map is a sophisticated digital map that integrates multiple layers of information, offering a clear and interactive understanding of the city’s real estate. It combines visual elements with data-driven insights, creating a powerful platform for analysis and decision-making.

Key Features of the NYC GIS Tax Map:

- Interactive Map Interface: The platform features a user-friendly interface that allows users to zoom, pan, and navigate the map with ease. This interactive nature enables users to explore specific areas of interest in detail.

-

Property Data: The map displays a wealth of information about individual properties, including:

- Block and Lot Numbers: These unique identifiers help locate properties within the city’s grid system.

- Property Address: The official street address of the property.

- Property Ownership: Information on the current owner(s) of the property.

- Property Size and Dimensions: Data on the physical dimensions of the property, including its area and boundaries.

- Tax Assessment: The assessed value of the property, which is used to determine property taxes.

- Building Information: Details on the building located on the property, including its size, type, and construction year.

- Zoning Information: Information on the zoning regulations applicable to the property, which can influence development and use.

- Data Layers: The map allows users to overlay various data layers, such as zoning districts, flood zones, and public transportation lines. This functionality enables users to analyze the impact of different factors on property values and development potential.

- Search Functionality: Users can easily search for specific properties by address, block and lot number, or owner name. This feature facilitates quick and efficient property identification.

- Data Download: The platform allows users to download property data in various formats, including CSV and shapefiles. This enables users to analyze the data offline and integrate it with other applications.

Benefits of Using the NYC GIS Tax Map:

- Real Estate Professionals: The map provides valuable insights into property values, ownership, and zoning regulations, enabling real estate agents, appraisers, and developers to make informed decisions about property acquisition, valuation, and development.

- Homeowners: The map allows homeowners to access information about their property, including its assessed value and zoning restrictions. This information can be helpful for understanding property taxes and potential renovation projects.

- Investors: The map provides valuable data for investors seeking to identify potential investment opportunities. By analyzing property values, zoning regulations, and neighborhood trends, investors can make informed decisions about property acquisition and development.

- Government Agencies: The map is a critical tool for city planners, zoning officials, and tax assessors. It provides a comprehensive view of the city’s real estate landscape, enabling them to manage resources, enforce regulations, and assess property values accurately.

- Researchers and Students: The map serves as a valuable resource for researchers and students studying urban development, real estate, and other related fields. It provides access to a wealth of data that can be used for analysis, research, and education.

Navigating the NYC GIS Tax Map: A Practical Guide

Accessing and utilizing the NYC GIS Tax Map is straightforward:

- Visit the NYC Department of Finance website: The official website for the NYC GIS Tax Map is hosted by the Department of Finance.

- Locate the GIS Tax Map link: The map can be accessed through the "Property Information" section of the website.

- Explore the map interface: Familiarize yourself with the map’s interactive features, including zoom, pan, and data layers.

- Search for properties: Use the search functionality to locate specific properties by address, block and lot number, or owner name.

- Analyze property data: Explore the information available for each property, including its assessed value, zoning regulations, and ownership details.

- Download data: Utilize the data download functionality to access property information in various formats for further analysis.

Frequently Asked Questions about the NYC GIS Tax Map:

- Q: How accurate is the information displayed on the NYC GIS Tax Map?

- A: The NYC GIS Tax Map is a dynamic database constantly updated with the latest information. However, it is essential to note that the information provided may not always be completely up-to-date due to the constant changes in the real estate market.

- Q: Is the information on the NYC GIS Tax Map publicly accessible?

- A: Yes, the information displayed on the NYC GIS Tax Map is publicly accessible. It is a valuable resource for anyone seeking information about properties in New York City.

- Q: Can I use the NYC GIS Tax Map to determine the fair market value of a property?

- A: While the map displays the assessed value of properties, it is not a definitive indicator of fair market value. Fair market value is determined by various factors, including market conditions, property features, and comparable sales.

- Q: Can I contact the Department of Finance directly if I have questions about the NYC GIS Tax Map?

- A: Yes, the Department of Finance provides contact information on its website for inquiries related to the NYC GIS Tax Map.

- Q: Is there a mobile app for the NYC GIS Tax Map?

- A: While there is no dedicated mobile app for the NYC GIS Tax Map, the website is optimized for mobile devices, allowing users to access the map and its features on their smartphones and tablets.

Tips for Using the NYC GIS Tax Map Effectively:

- Familiarize yourself with the map interface: Spend time exploring the map’s features, including zoom, pan, and data layers.

- Use the search functionality effectively: Utilize the search function to quickly locate specific properties by address, block and lot number, or owner name.

- Overlay data layers: Experiment with different data layers, such as zoning districts and flood zones, to gain a comprehensive understanding of the property’s context.

- Compare properties: Use the map to compare property values, zoning regulations, and other factors across different neighborhoods.

- Consult additional resources: Remember that the NYC GIS Tax Map is one tool among many. Use it in conjunction with other resources, such as real estate websites and market reports, to make informed decisions.

Conclusion: Empowering Informed Decisions Through Data and Visualization

The NYC GIS Tax Map is a powerful tool that provides a comprehensive and interactive view of the city’s real estate landscape. By combining visual elements with data-driven insights, it empowers various stakeholders to make informed decisions about property acquisition, development, and investment. Whether you are a real estate professional, homeowner, investor, or simply curious about the city’s property landscape, the NYC GIS Tax Map offers a valuable resource for navigating the complexities of New York City’s real estate market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the City: A Comprehensive Guide to the NYC GIS Tax Map. We hope you find this article informative and beneficial. See you in our next article!