Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map

Related Articles: Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map

- 2 Introduction

- 3 Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map

- 3.1 The Foundation of Information: Understanding the Surry County GIS Tax Map

- 3.2 Benefits of the Surry County GIS Tax Map: A Multifaceted Resource

- 3.3 Navigating the Surry County GIS Tax Map: A User-Friendly Experience

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Tips for Effective Use of the Surry County GIS Tax Map

- 3.6 Conclusion: A Powerful Tool for Informed Decision-Making

- 4 Closure

Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map

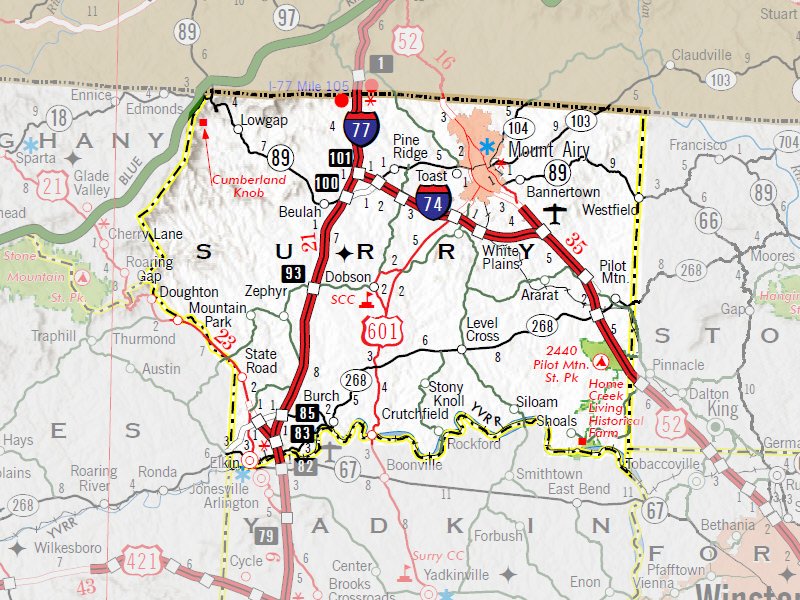

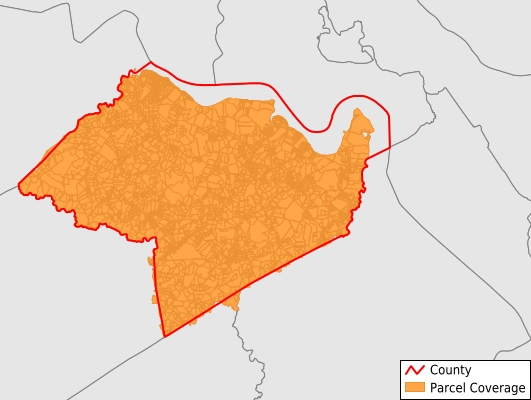

Surry County, North Carolina, like many other jurisdictions, employs a sophisticated Geographic Information System (GIS) to manage and visualize its tax records. This digital map, commonly referred to as the Surry County GIS Tax Map, serves as a central repository of information related to property ownership, assessment values, and tax liabilities. Understanding this valuable resource unlocks a wealth of insights for residents, businesses, and government agencies alike.

The Foundation of Information: Understanding the Surry County GIS Tax Map

The Surry County GIS Tax Map is a digital representation of the county’s land parcels. It’s not merely a static image; it’s an interactive database containing a wealth of information associated with each property. This data includes:

- Parcel Identification Numbers (PINs): Unique identifiers assigned to each property, crucial for accurate record-keeping and retrieval.

- Property Ownership: Details about the current owners, including names, addresses, and contact information.

- Property Boundaries: Precisely defined boundaries of each parcel, ensuring accurate representation of ownership and land usage.

- Assessment Values: The assessed value of each property, used for calculating property taxes.

- Tax Liabilities: Information regarding outstanding property taxes, including due dates and payment history.

- Land Use: Categorization of land usage, such as residential, commercial, agricultural, or industrial.

- Zoning Information: Details on applicable zoning regulations, including restrictions on development and land use.

This comprehensive data set provides a clear and concise picture of the county’s land ownership, assessment values, and tax liabilities, making it a valuable resource for various stakeholders.

Benefits of the Surry County GIS Tax Map: A Multifaceted Resource

The Surry County GIS Tax Map offers a multitude of benefits, serving as a vital tool for:

1. Property Owners:

- Accurate Property Information: Provides readily accessible and accurate details about property ownership, boundaries, and assessment values, eliminating confusion and ensuring transparency.

- Tax Payment Tracking: Enables property owners to monitor their tax liabilities, payment history, and due dates, facilitating timely payments and avoiding penalties.

- Understanding Property Value: Provides insights into property values, allowing owners to track changes and make informed decisions about their property.

2. Real Estate Professionals:

- Property Research: Offers a comprehensive database for researching property details, including ownership, boundaries, and assessment values, streamlining property transactions.

- Market Analysis: Facilitates market analysis by providing data on property values, land use, and zoning regulations, aiding in pricing strategies and investment decisions.

- Property Due Diligence: Provides valuable information for conducting due diligence on properties, ensuring accurate information and minimizing risks during transactions.

3. Government Agencies:

- Tax Administration: Streamlines tax administration by providing a central database for managing property records, assessment values, and tax liabilities, ensuring efficient and accurate tax collection.

- Land Management: Provides a comprehensive view of land ownership, usage, and zoning regulations, facilitating effective land management and development planning.

- Emergency Response: Offers valuable information for emergency responders, such as property locations, boundaries, and access points, aiding in efficient response and resource allocation.

4. Public Access and Transparency:

- Community Engagement: Provides public access to property information, fostering transparency and promoting community engagement in land use planning and development.

- Data-Driven Decisions: Empowers citizens with data-driven insights into property values, tax liabilities, and land use patterns, enabling informed participation in local government decisions.

Navigating the Surry County GIS Tax Map: A User-Friendly Experience

Surry County’s GIS Tax Map is designed with user-friendliness in mind, providing a variety of options for accessing and navigating its vast data. The most common methods include:

1. Online Access:

- Surry County Website: The county website typically hosts a dedicated GIS portal, allowing users to search for properties by PIN, address, or owner name.

- Interactive Maps: The portal often features interactive maps, allowing users to zoom, pan, and explore the county’s land parcels.

- Data Download: Users can often download property data in various formats, such as spreadsheets or shapefiles, for further analysis or integration into other applications.

2. Mobile App:

- Mobile GIS Apps: Surry County may offer a dedicated mobile app, providing access to the GIS Tax Map on smartphones and tablets.

- Offline Access: Some mobile apps allow users to download data for offline access, enabling convenient research even without internet connectivity.

3. Public Access:

- County Offices: The Surry County Tax Assessor’s office typically provides public access to the GIS Tax Map, allowing users to view property information on site.

- Public Meetings: The county may host public meetings or workshops to educate residents and stakeholders on using the GIS Tax Map.

Frequently Asked Questions (FAQs)

Q: What information is included in the Surry County GIS Tax Map?

A: The GIS Tax Map contains a wealth of information, including property ownership, boundaries, assessment values, tax liabilities, land use, and zoning regulations.

Q: How can I access the Surry County GIS Tax Map?

A: The GIS Tax Map is typically accessible through the Surry County website, a dedicated mobile app, or in person at the Tax Assessor’s office.

Q: Can I download property data from the GIS Tax Map?

A: Yes, many GIS portals allow users to download property data in various formats, such as spreadsheets or shapefiles.

Q: How can I use the GIS Tax Map to find property information?

A: You can search for properties by PIN, address, or owner name. The interactive maps allow you to zoom, pan, and explore the county’s land parcels.

Q: How accurate is the information on the GIS Tax Map?

A: The information on the GIS Tax Map is generally considered accurate and updated regularly. However, it’s always advisable to verify information with official sources.

Q: Is the Surry County GIS Tax Map free to use?

A: Access to the GIS Tax Map is typically free for public use. However, certain data downloads or advanced functionalities may require a fee.

Q: How do I report errors or inaccuracies in the GIS Tax Map?

A: You can typically report errors or inaccuracies by contacting the Surry County Tax Assessor’s office directly.

Tips for Effective Use of the Surry County GIS Tax Map

- Familiarize Yourself with the Interface: Take the time to explore the GIS portal or mobile app, understanding its navigation and search functionalities.

- Utilize Search Options: Explore various search options, such as PIN, address, or owner name, to find the specific information you need.

- Verify Information: While the GIS Tax Map is generally accurate, it’s always advisable to verify critical information with official sources, such as property deeds or tax bills.

- Download Data for Analysis: If you need to analyze property data, download it in a suitable format, such as spreadsheets or shapefiles, for further processing.

- Attend Public Meetings: Stay informed about public meetings or workshops related to the GIS Tax Map, ensuring you understand its latest updates and features.

Conclusion: A Powerful Tool for Informed Decision-Making

The Surry County GIS Tax Map is a powerful tool that empowers residents, businesses, and government agencies with access to vital information about property ownership, assessment values, and tax liabilities. By leveraging this resource, stakeholders can make informed decisions related to property transactions, land use planning, and tax administration. As technology continues to evolve, the Surry County GIS Tax Map is poised to become even more comprehensive and user-friendly, further enhancing its role as a vital resource for the community.

Closure

Thus, we hope this article has provided valuable insights into Delving into the Data: Unlocking the Secrets of Surry County’s GIS Tax Map. We appreciate your attention to our article. See you in our next article!